53+ how much of your mortgage interest is tax deductible

If you rent it out for a total of. Web For example if you rent out the property for a total of two months in the year you can deduct 212 167 of your mortgage interest.

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Homeowners who purchased their property on or after December 15 2017 are able to deduct interest paid on mortgages valued up to. If your mortgage originated between October 13 1987.

TaxInterest is the standard that helps you calculate the correct amounts. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The interest on an additional.

However higher limitations 1 million 500000 if married. Homeowners who bought houses before. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage.

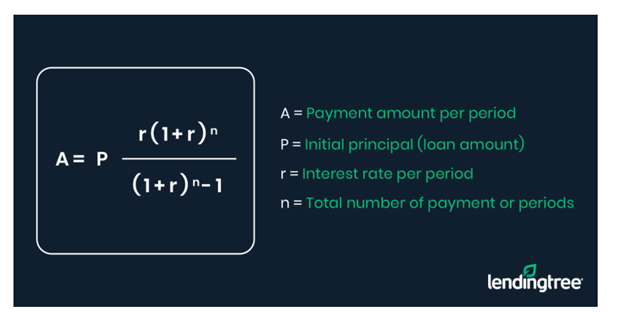

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt.

If you are single or married and. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

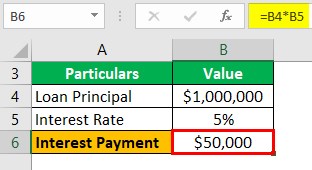

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web According to the tax code this homeowners deductions for mortgage interest and property taxes would be evaluated at a 15 percent marginal tax rate.

Is mortgage interest tax deductible. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Compare offers from our partners side by side and find the perfect lender for you.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Assuming your marginal tax rate is 25 you could save 2500 in taxes just like that. Of claiming the home.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web By taking the mortgage interest deduction your taxable income would fall to 65000.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web If you took out your mortgage on or before October 13 1987 your mortgage interest is fully deductible without limits. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions.

For tax year 2022 those amounts are rising to. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Web Here is an overview of which mortgage costs might be tax deductible for you in 2023.

Current IRS rules allow many homeowners to. Web A reader asks Bankrates tax adviser if she can claim mortgage interest on her third home. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Broker Australia Low Rate Home Loan

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction How It Calculate Tax Savings

The Home Mortgage Interest Deduction Lendingtree

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

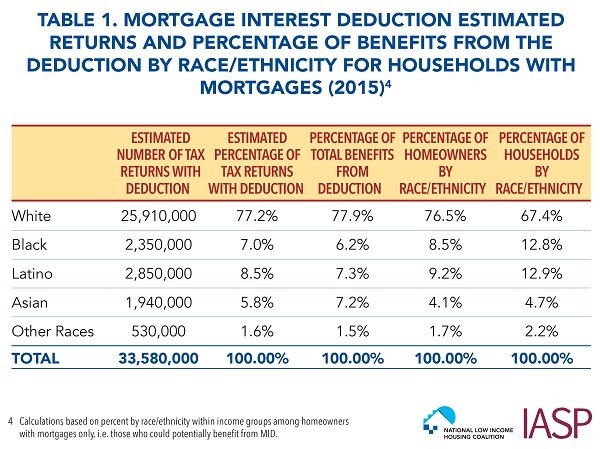

Race And Housing Series Mortgage Interest Deduction

The Home Mortgage Interest Deduction Lendingtree

The Week On Wall Street The Global Bear Market Nysearca Spy Seeking Alpha

Mortgage Interest Deduction Bankrate

Maximum Mortgage Tax Deduction Benefit Depends On Income

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

What Tax Breaks Do Homeowners Get In New York

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

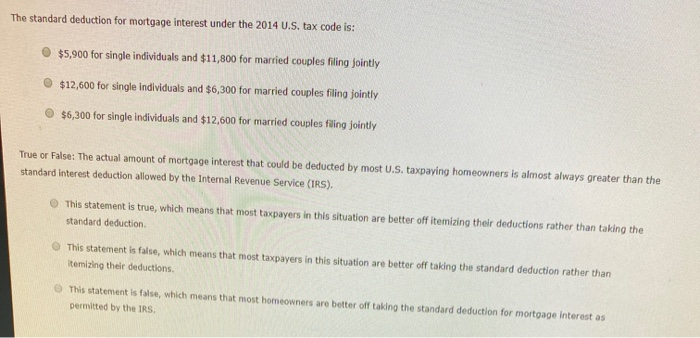

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

Can You Claim Mortgage Interest On Taxes Pocketsense